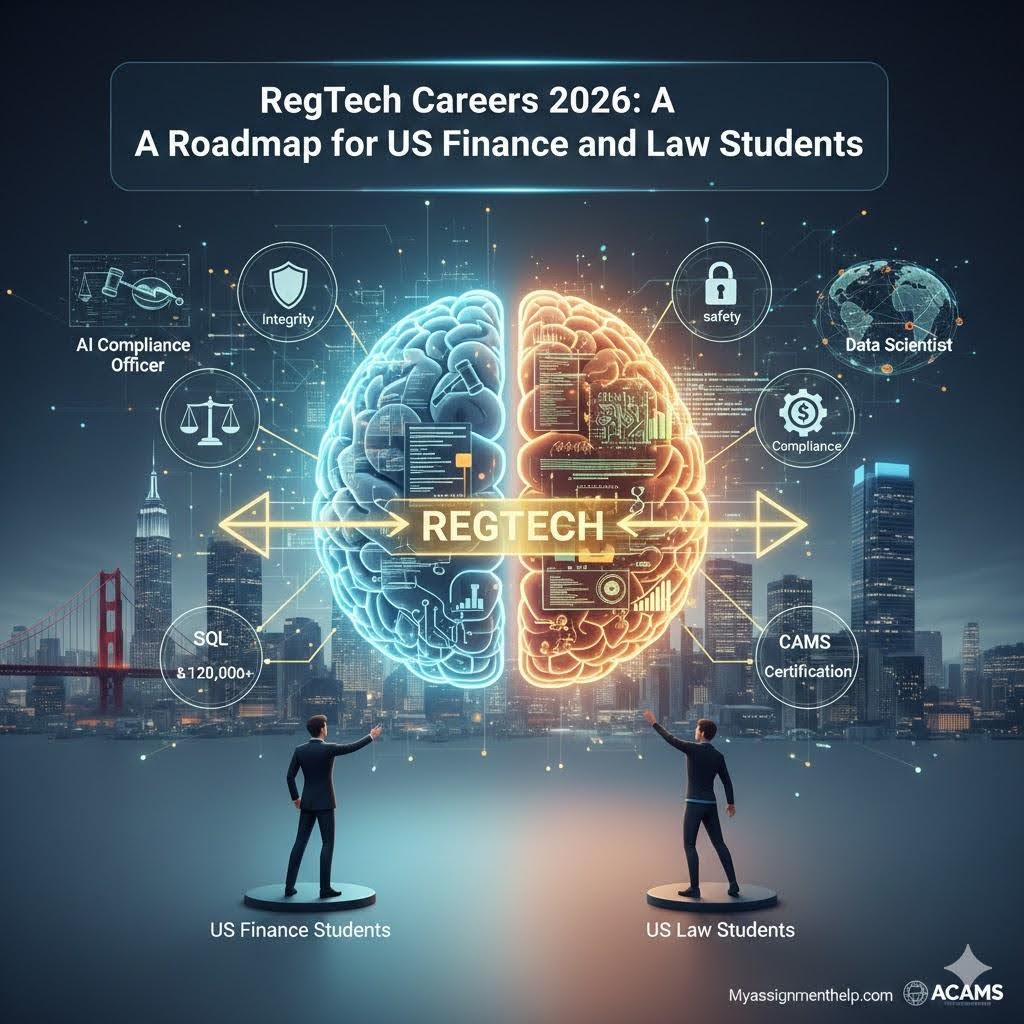

1. The 2026 Landscape: Why RegTech is Exploding

In 2026, compliance has shifted from "reactive" to "proactive." With the full implementation of the GENIUS Act in the U.S. and stricter AI governance protocols, financial institutions now use real-time automation to preempt financial crimes.

The Great Shift: The demand for "traditional" compliance officers is shrinking. In their place, the Tech-Enabled Compliance Specialist has become the most valuable asset in the room—the individual who can bridge the gap between complex legal jargon and automated software.

2. What is RegTech?

RegTech (Regulatory Technology) focuses on integrity and safety—ensuring financial activities follow the law. While FinTech focuses on how people spend and save, RegTech ensures those activities are legal and secure.

- Market Growth: Careers are surging as institutions prioritize automated compliance.

- Key Roles: Compliance Analysts, Risk Engineers, and Data Scientists.

- Compensation: Salaries often exceed $120,000 in major hubs.

- Focus: AI-driven regulatory reporting, AML (Anti-Money Laundering), and KYC (Know Your Customer).

3. Academic Pathways: How to Prepare Now

The 2026 job market values a "hybrid" skill set. Here is how to align your education at every level:

A. High School Students

- Focus: Prioritize AP Statistics and Computer Science.

- Objective: Understand that the logic of an algorithm is now as important as the logic of a legal argument.

- Extracurricular: Participate in Mock Trial to build an analytical legal mindset.

B. Undergraduate (Finance & Business)

- Electives: Prioritize FinTech, Data Analytics, or Cybersecurity.

- Internships: Target firms like Stripe, Plaid, or Chainalysis.

- Skill-Building: Focus on "Skills-Based Hiring" by building a portfolio of SQL queries or data projects.

C. Law Students (JD/LLM)

- Specialization: Focus on Cyber Law, Intellectual Property, or AI Ethics.

- The Gold Standard: Pursue a joint JD/MS in Data Science.

- Success Tip: Navigating these complex subjects is intense. Many students leverage academic assistance, such as law assignment help to protect their GPA in core subjects while dedicating time to emerging tech certifications.

4. Top US Universities for RegTech (2026)

These institutions offer RegTech as a core component of their degrees, focusing on the intersection of AI, blockchain, and law.

| University | Program Name | Key RegTech Focus |

| NYU (Stern) | MS in FinTech | Legal, ethical, and regulatory frameworks in NYC. |

| Duke (Pratt) | M.Eng in FinTech | Automation in compliance and financial data. |

| UT Dallas | MS FinTech & Analytics | Digital banking and regulatory modules. |

| Case Western | FinTech Certificate | Specialized "Banking and RegTech" course. |

| Mercer University | Graduate Certificate | Dedicated Compliance, Regulation, and Analytics. |

Where to Turn: Support Systems for Aspiring RegTech Professionals

Navigating the intersection of law and technology can be intense. For academic hurdles, students often leverage specialized reputed websites like Myassignmenthelp.com to maintain high GPAs while focusing on technical certifications. For career growth, join professional bodies like ACAMS or the International RegTech Association (IRTA).

5. Top 3 Career Paths & Salary Outlook

1. AI Compliance Officer (Legal Focus)

Major U.S. banks (JP Morgan, Goldman Sachs) now use Agentic AI to monitor transactions. Law students are needed to ensure these models comply with the Fair Credit Reporting Act (FCRA) and Section 1033 data-sharing rules.

- Avg. Salary: $110,000 (Legal Technologist)

- Hubs: NYC / Washington D.C.

2. RegTech Product Manager (Finance Focus)

The "translator" role. You must understand the pain points of a CFO and help engineers build software to solve them. You don’t need to be a senior coder, but you must understand global financial data flows.

- Avg. Salary: $92,000 (Compliance Data Analyst)

- Hubs: Charlotte / Chicago

3. Financial Crime Tech Specialist

This role involves tracking crypto-native compliance and Institutional DeFi ecosystems. With increased SEC/IRS focus on digital assets, these specialists are among the highest-paid entry-level professionals.

- Avg. Salary: $135,000 (Risk Systems Architect)

- Hubs: San Francisco / Austin

6. The "Must-Have" Skill Stack

To land a role in 2026, you need a "T-shaped" skill set:

- Data Literacy: Proficiency in SQL and visualization tools like Tableau or PowerBI.

- AI Governance: Using Large Language Models (LLMs) to summarize 500-page regulatory documents and auditing AI decision-making.

- Certifications: CAMS (Certified Anti-Money Laundering Specialist) or the Professional RegTech Certificate are now industry standards.

Conclusion: Don’t Just Study the Law—Code It

In 2026, the most successful professionals will be those who speak the language of both the courtroom and the cloud. By aligning your studies today with the RegTech demands of tomorrow, you aren't just getting a degree—you're gaining a permanent competitive advantage.

Author Bio: Karson Paul is a leading Regulatory Technology Consultant with over a decade of experience advising Tier-1 financial institutions on AI governance and AML automation. As a blog author and career strategist, Karson bridges the gap between legislative intent and technical execution. His insights are frequently cited in industry-leading publications such as FinTech Global and The RegTech Directory.

Frequently Asked Questions (FAQ)

Q.1 Do I need to know how to code to work in RegTech?

Not necessarily, but you must be "code-literate." While Architects need deep programming knowledge, Product Managers simply need to understand APIs and how to query data using SQL.

Q:2 Which U.S. cities are the biggest hubs?

New York City (Policy/Wall St), Charlotte (Banking Ops), and San Francisco (Fintech Innovation). Austin and D.C. are leading in AI governance.

Q:3 Is RegTech more stable than FinTech?

Often, yes. FinTech is driven by consumer trends; RegTech is driven by law. Compliance is a legal requirement, not an optional expense, providing greater job security during market fluctuations.